Tax Bills Now Available- March 1st Due Date

- Tax Bills and Amounts are now available under the Property Search option for the Auditor's Website.

- Bill were mailed Feb 6th with Payments are due March 1st to the Treasurer's Office

- The Districts of Jefferson Village, Jefferson Emergency Rescue District, Colebrook Township, and Rome Township will see increases due to newly passed levies.

- The Children Services Board, Pymatuning Valley Schools, Geneva on the Lake Village, and Austinburg Township all voluntarily decreased their tax rates.

2023 Tax Increases Due to New Levies, Tax Rates Now Certified

Jefferson- Ashtabula County Auditor David Thomas has certified the real property tax amounts payable in 2023 to County Treasurer Angie Maki-Cliff after a several weeks long delay for non-office related circumstances.

Tax charges are available for property owners to view on the County Auditor’s website where property owners can print off their bill or view charge summary information. Property owners have until an extended deadline of March 1st to pay the first half charge of their property taxes to the County Treasurer.

“This was a rather uneventful year for our office in terms of tax calculation and changes in property information until the final few steps which caused delays,” explained Auditor Thomas. “Our county only saw a handful of new levies or changes and so our role was easy. The time delay was us working with our vendor to finalize rates for the county.”

Four local governments voluntarily lowered their tax rates for 2023 payments. The Children Services board lowered their collections by .5 mills, Pymatuning Valley Schools’ Bond Levy will decrease by 1.7 Mills, Geneva on the Lake will not collect their 1.7 Mill Ambulance Bond, and the Austinburg Township Fire Truck Bond will decrease by .25 Mills for this year’s tax charges.

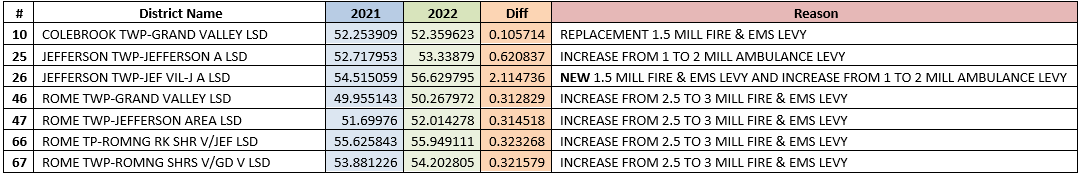

Voters however did pass several tax increases resulting in effective tax rates rising. Jefferson Village passed a new 1.5 Mill fire levy, Jefferson Emergency Rescue District increased their Ambulance Levy from 1 to 2 Mills, Colebrook Township replaced their 1.5 Mill Fire and EMS Levy, and Rome Township increase their Fire and EMS Levy from 2.5 Mills to 3 Mills.

“Unless you live in an area that voted in an increase, likely your taxes stayed constant or actually decreased this year,” shared Auditor Thomas. “I encourage everyone to look on our website to view their tax distribution, bill, and property info.”

The Auditor’s Office certified over the tax amounts on January 25th to the Treasurer’s Office which began Treasurer Angie Maki-Cliff’s work to prepare tax bills and get information to mortgage companies and banks.

Treasurer Maki-Cliff says her office is ready and prepared to take tax payments now for property owners wishing to pay prior to receiving their bill in the mail. “We have lots of options for people to pay their tax bill,” Maki-Cliff stated, “credit card, check, over the phone, online, and even cash in person if people would like.”

In addition to traditional payments twice a year with first and second half, Maki-Cliff and her office are also reminding property owners that they have the option to pay on a payment plan and work with the Treasurer’s Office on what fits their needs. “We try to be as flexible as possible and are always happy to work with tax payers to lower the burden of tax payments,” explained Maki-Cliff.

Tax bills excluding mobile homes are being mailed out soon and due March 1, but are available to be paid now by looking on the Auditor’s website for the information. Mobile home bills will be delivered in several weeks with a later due also.

Thomas acknowledged that no one enjoys paying taxes, “but we have many resources on our website to learn where your charge comes from, what the money goes to, and how you can appeal or lower your tax amount.” The Auditor’s Office has seen a large increase in tax credit applications which Thomas credits to more outreach and education on offerings such as Homestead, Owner Occupancy, and CAUV. He says now is the time to learn more about those programs and sign up with the Auditor’s Office.

Tax payers are encouraged to ask questions and reach out to either the Auditor or Treasurer’s Office for questions or assistance.

The official certification of taxes to the Treasurer’s Office also starts the clock for Board of Revision complaints explained Thomas. Property owners have until March 31st to file a property value complaint with the Auditor’s Office. “The BOR process is for those who believe that our market value is above what they could have sold their property for on the open market on January 1, 2022,” said Auditor Thomas.

The Auditor’s Office will once again this year be holding education sessions for the public on the CAUV agriculture credit, Board of Revision, and other tax credits.

5051