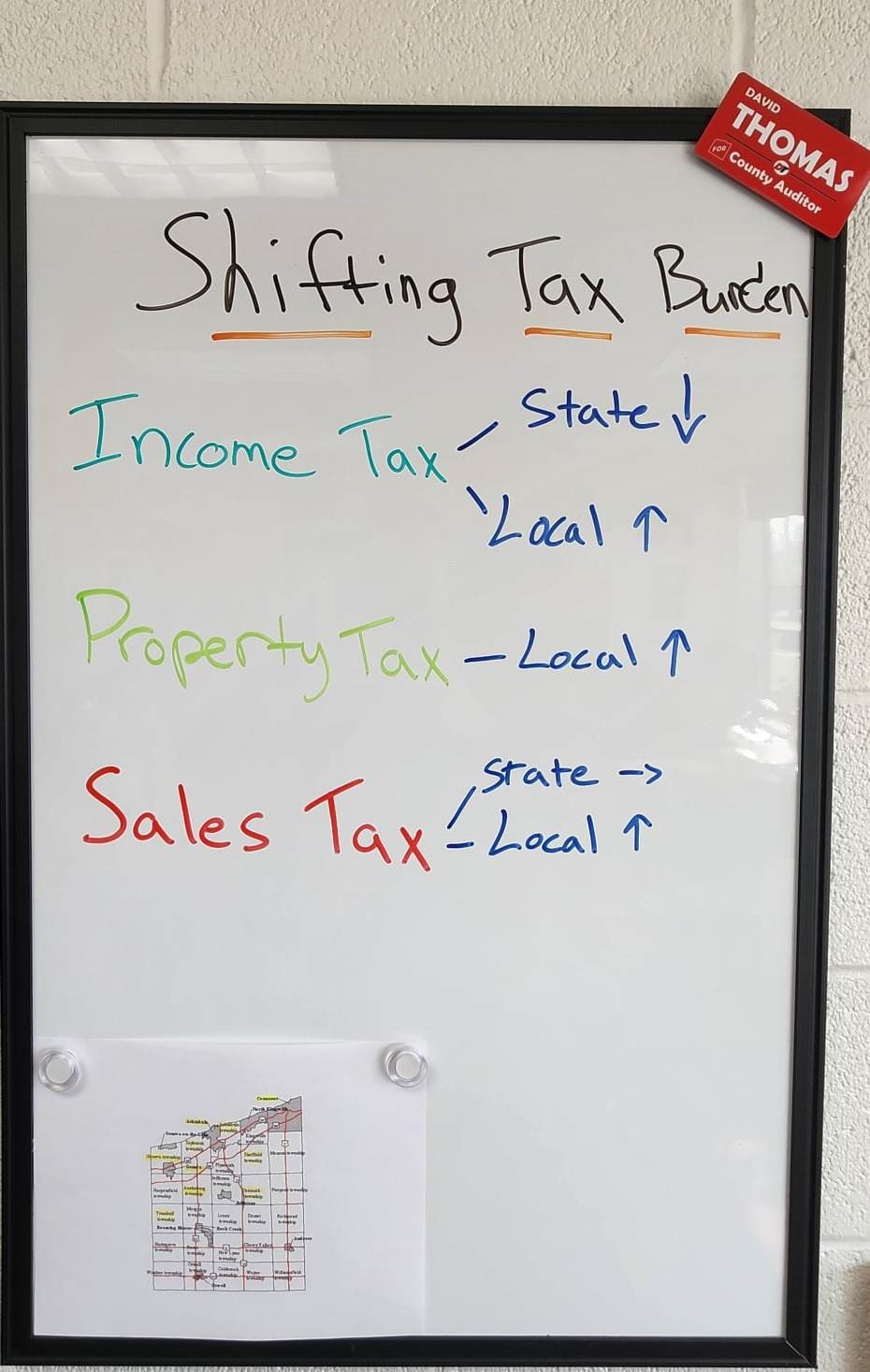

Shifting Tax Burden- Info on Ohio Tax Policy

Why have your property taxes increased over the last 10 years if your property market value has stayed roughly the same? Simple- a Shifting Tax Burden from the State Level to the Local Level.

I help to very briefly overview how changes in State Level tax policy has decreased your taxes paid to the state like Income Tax, but shifted those amounts to higher Local Government Level taxes like Property Taxes. Watch video here

Can't cover everything in a short video, but the concept is straightforward. State Level decreases money given to Local Level by decreasing Income Tax. Local Level (fire, police, schools, etc) have decreased State Level dollars and thus, ask for new levies on Property Tax Bills to cover the difference.

Why does this matter? You went from helping to pay for Local Government Services in part through State Level taxes, but now predominately pay for them through Property Taxes. Think of who pays income taxes vs property taxes and why then, property taxes have increased to cover the gap.

4180