Homestead & Tax Payment Education Sessions

Register for the Zoom Option for July 13th at 3:30pm

Register for the Zoom Option for July 24th at 6:30pm

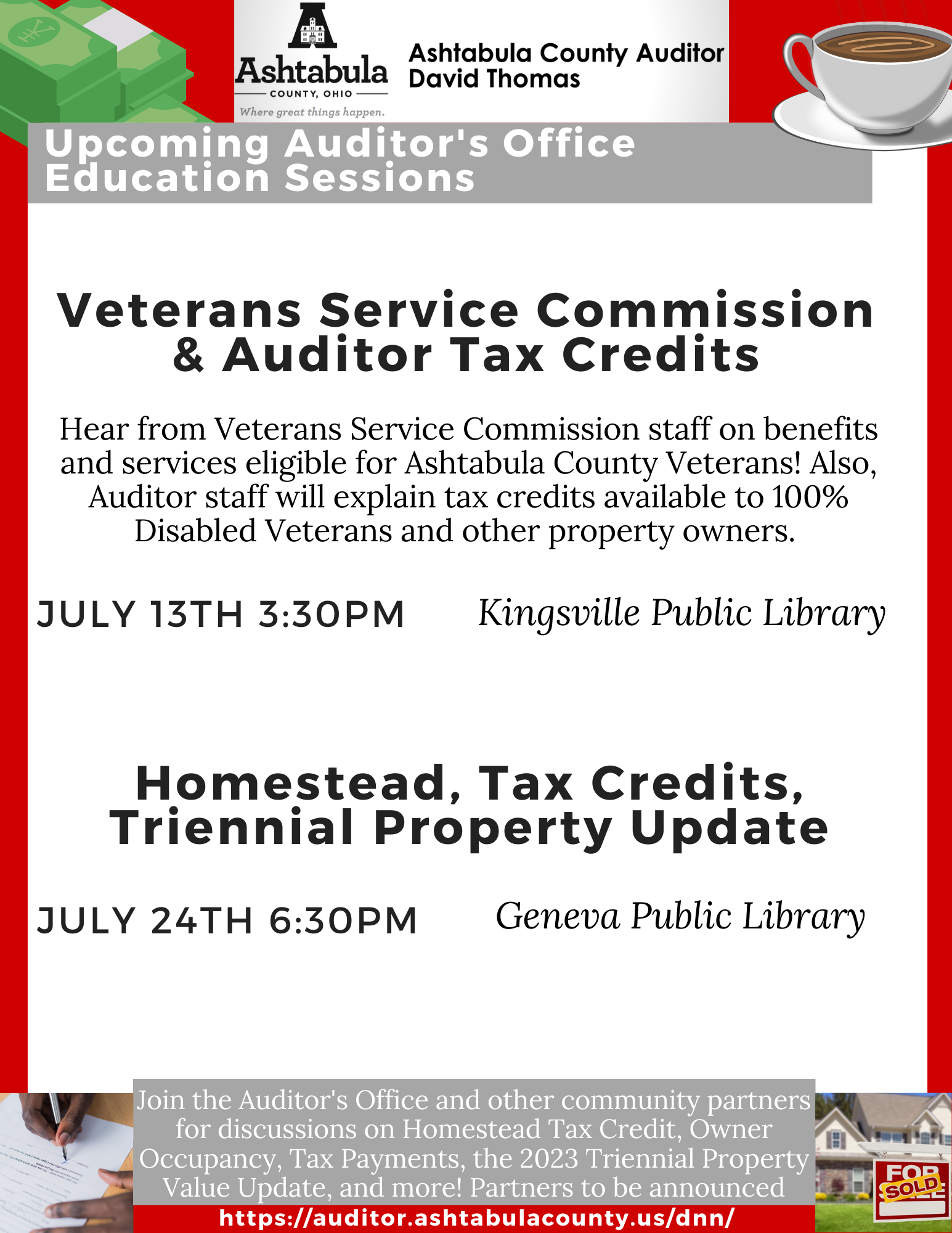

County Auditor to Host Homestead, Taxes, and Community Partners Education Sessions

Jefferson- Ashtabula County Auditor David Thomas will be taking to the road this summer to educate county property owners on property tax savings they may be eligible for in addition to news on the 2023 State Mandated Triennial Value Update. Thomas has also contacted Auditor’s Office community partners to join as well. Partners and the sessions they will be attending will be on the Auditor’s website.

“I am really excited to bring this yearly opportunity our local residents so you can learn and ask questions,” said Auditor Thomas.

Future sessions will be held at:

-Kingsville Public Library on Thursday, July 13th at 3:30pm (Veterans Service Commission)

-Geneva Public Library on Monday, July 24th at 6:30pm.

“We want to make learning and taking advantage of local government offerings as easy as possible for folks,” explained Auditor Thomas. “Especially the Homestead Tax Credit for our retired or disabled residents and information on value changes.”

Thomas says he is excited to be welcoming the Ashtabula County Veterans Service Commission (VSC) for the Thursday, July 13th session at the Kingsville Library. The offices work together often on Veterans Homestead credits and the VSC will share with attendees more about their organization and the opportunities available for veterans to receive eligible benefits.

Those who are unable to attend in person can watch online by Zoom or Facebook live. To register for Zoom, attendees can visit the County Auditor website or contact Auditor Thomas at 440-576-3785 or djthomas@ashtabulacounty.us. No pre-registration for in person attendance is needed but coffee and cookies will be provided.

County Auditor Thomas plans to inform attendees about tax credits including the Homestead Tax Credit, Owner Occupancy Credit, and property value questions relating to the 2023 Triennial Property Update.

Tax payers who are 65 years or older and own their home with an annual adjusted Ohio Gross Income of less than $36,400, are permanently disabled, or are military veterans permanently disabled from a service related injury are encouraged to attend one of these sessions to learn more about the program. These are the basic qualifications for Homestead.

Homestead tax savings for applicants include a reduction equaled up to $25,000 tax credit on the market value of the home for traditional Homestead and $50,000 for disabled military veterans.

“At one of our last sessions, it was a real honor to meet a military disabled veteran who didn’t know about the credit and we were able to get him the money he qualified for which was awesome,” stated Auditor Thomas.

Thomas has contacted other county government agencies to also provide important information. When they are confirmed the Auditor’s Office website will be updated.

5561