Learn About Your Property Values

Questions on your Tax Charge or Property Value?

No one likes to pay taxes, but we will do our best to explain and provide you information for your Property Values and Taxes.

Great article from the Columbus Dispatch with an overview of Property Tax need to knows.

1. If you are not happy with your tax amount or want to learn more- first look at your Property Value.

-Click here to see how to find your value.

- Did your taxes increase more than your value? Learn more here.

-Watch a video from Auditor David Thomas explaining how to use Auditor Office resources to learn about your property value and taxes.

-Watch a webinar from Auditor David Thomas giving an overview of Property Taxes 101 for Property Owners!

-Click here for a PDF explaination of Tax Rates, Value Changes, and the Auditor's Role.

2. Did your value change? Your old Value is from the market value amount our office believed to be correct for your property on January 1, 2021 and your new value is for January 1, 2022. If you believe your new value is not what your property is worth on the market for January 1, 2022:

-Read about the Revaluation Process- we looked at all 80,000 parcels in the County to determine your updated market rate for January 1, 2022.

-Read about and File a Board of Revision complaint to challenge your property value

3. If you believe your value is correct but you are not happy with your tax amount:

-Learn about tax credits which may be available to you- Homestead and Owner Occupancy or CAUV

-Watch a webinar from Auditor David Thomas giving an overview of Property Taxes 101 for Property Owners!

-Click here for a PDF explaination of Tax Rates, Value Changes, and the Auditor's Role.

4. If you would like to contact our office to learn more or ask questions:

-Click here to contact us

-Click here to read more information

More information important to know for your property value and taxes

The Auditor’s Office role in your tax bill is to assess the market value on your property and calculate your taxable amount based on your location and tax district. The Auditor’s website has a good amount of information for you on your valuation and tax information.

For questions regarding your valuation, please contact the Auditor’s Office at 440-576-3783. For questions regarding payments, please contact the Treasurer’s Office at 440-576-3727.

Below are examples of screens on the Auditor’s website which have important information for your property. It is important to note that all values and tax amounts are based on 1/1/2022.

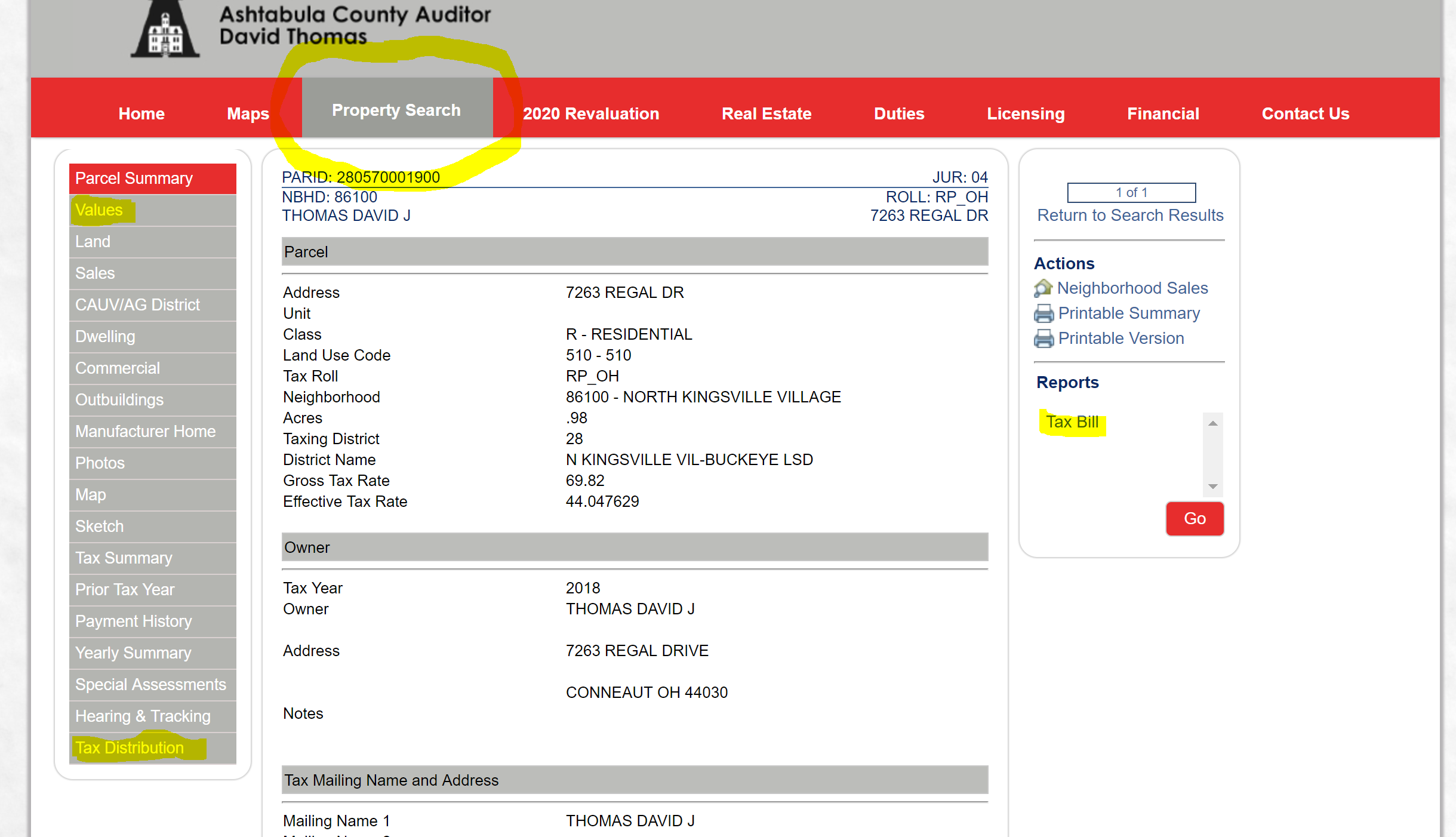

The Parcel Summary tab shows the page after you have searched your property. This is the main screen for your values and will direct you towards a treasure trove of individualized info. Residents can also print off their individual tax bill by pressing tax bill on the right side of the screen. You must turn pop-up blocker off and should print the bill in Full Size (not the defaulted Shrink to Fit):

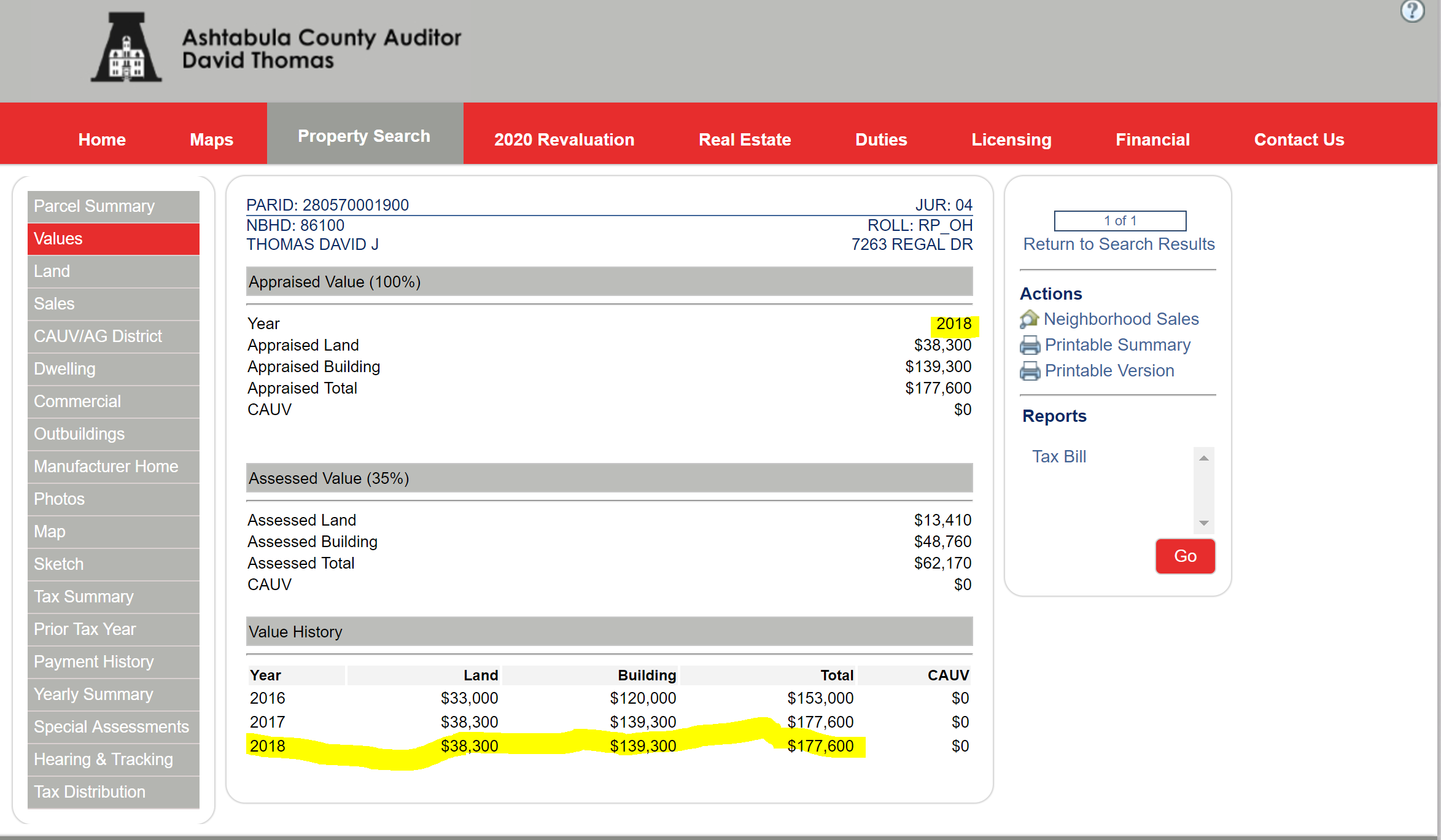

The Values tab displays the values of your property over the past 3 years on January 1st of each year:

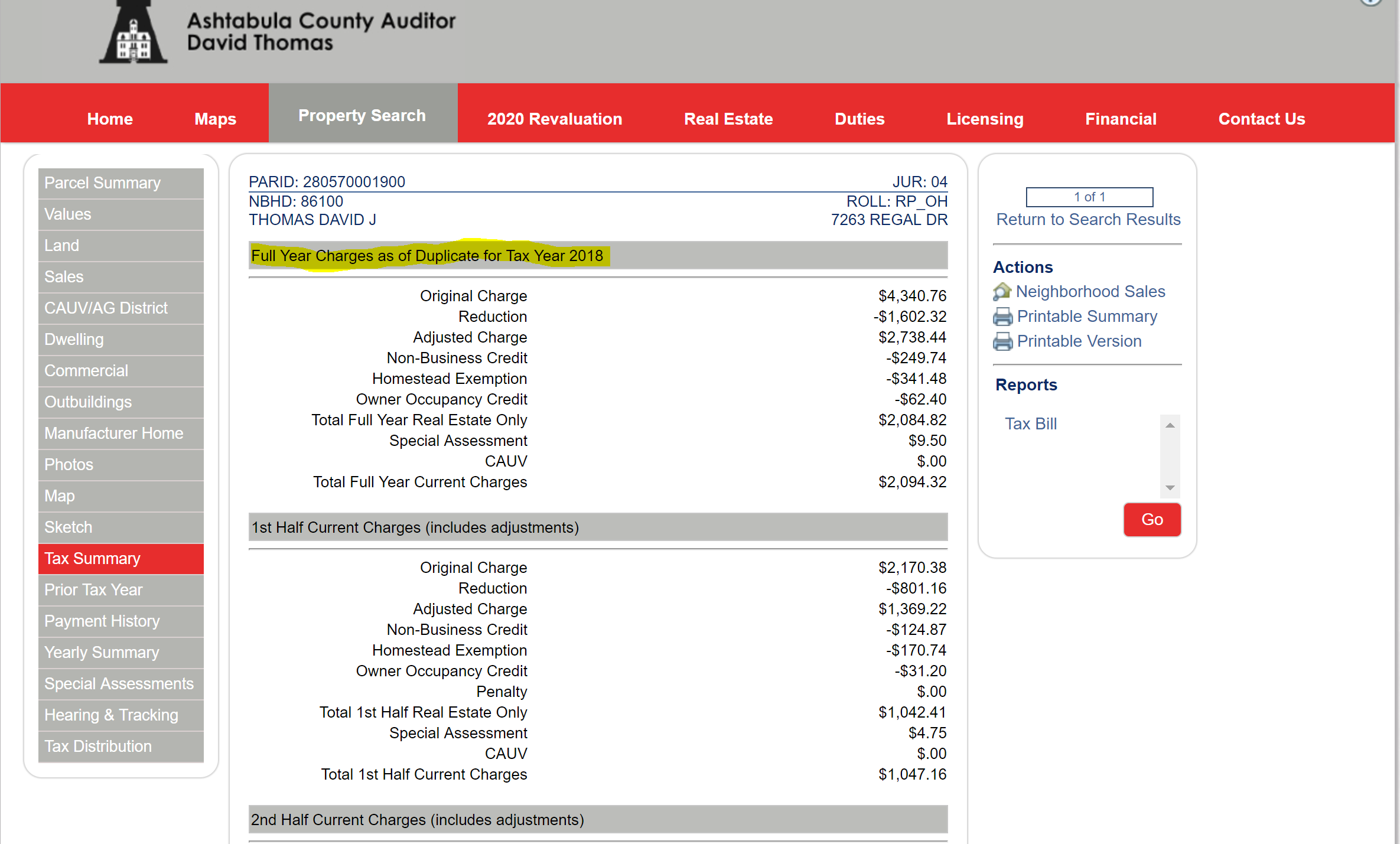

The Tax Summary tab shows the tax calculation on your property and any tax credits you may be receiving and the reduction of your tax burden based on the local tax district:

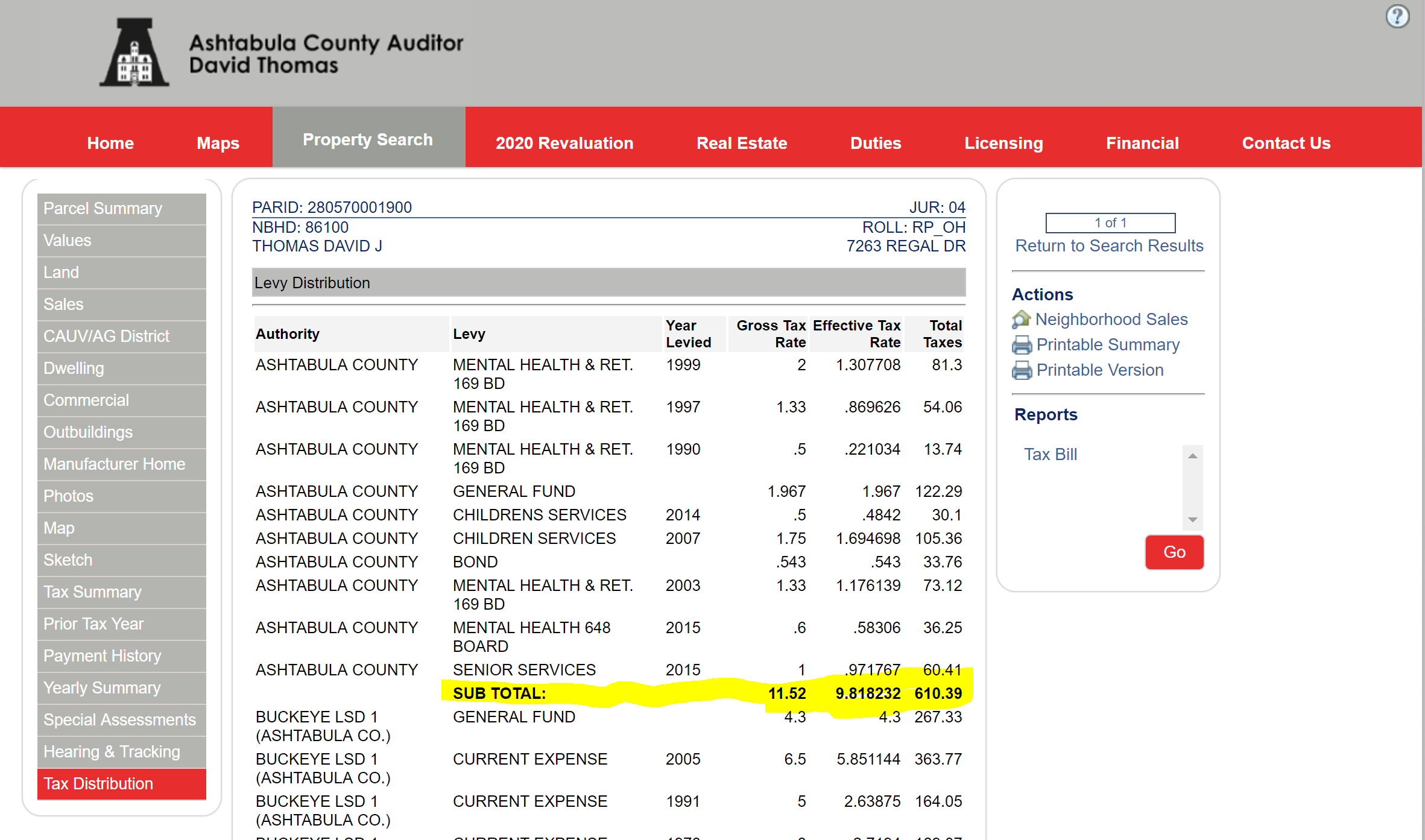

The Tax Distribution tab gives your total tax distribution based on each levy. This screen shows the amount of mills in collection for each levy in your tax district as well as the total distribution per authority for your tax dollars:

Should you have any questions over these tabs or other matters, please don’t hesitate to contact the Auditor’s Office today!

31092