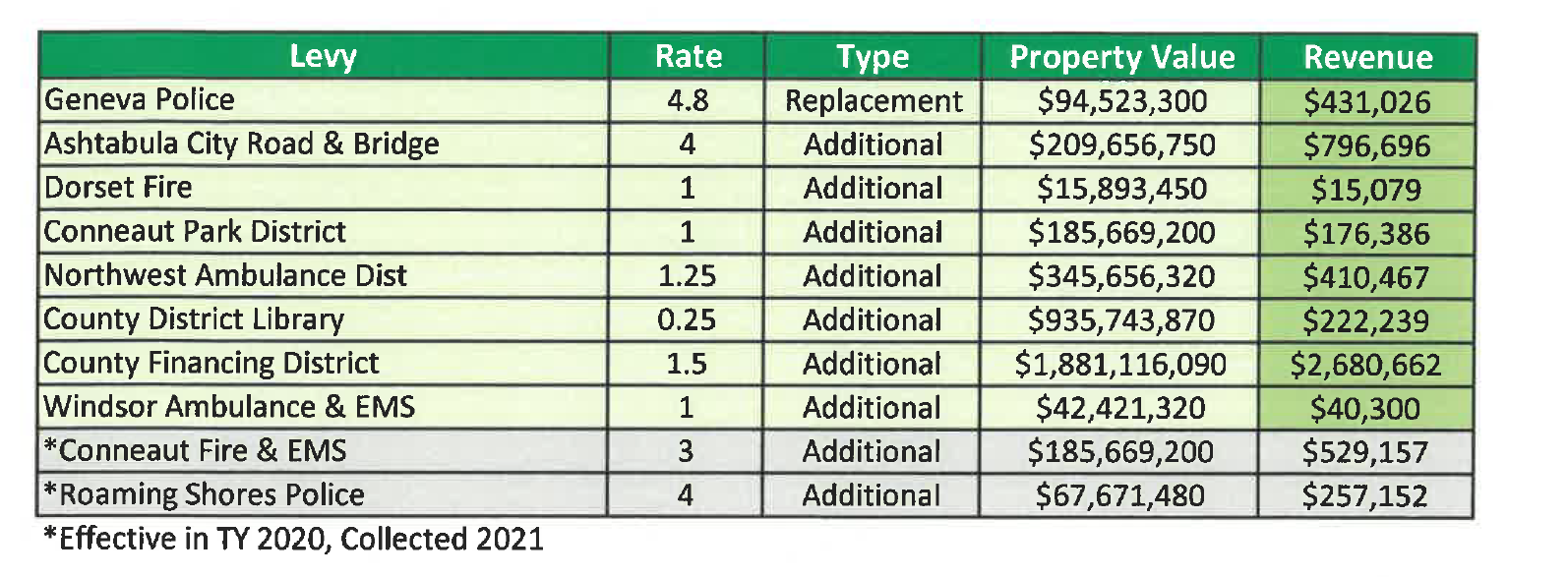

Tax Rate Increases Due to 2019 Levy Passages

Many residents have contacted the Auditor's Office regarding tax changes to their property. It is important to remember several key aspects to property taxes. To view how to see your tax distribution and details on where your tax money goes, click here

The Auditor’s Office role is to determine property value, assign tax rates passed by the voters, subtract credits and reduction factors, and assess the resulting tax amounts to the property.

The voters passed 9 additional levies in 2019 which resulted in new taxes for all property owners throughout the county. As new value is added and the tax burden is shared among new homes and businesses, individual’s taxes for these new levies will decrease. Until that occurs, they will collect at their full rates.

Voters passed an additional $5,613,000 worth of property taxes in 2019. These taxes are based on property values for January 1, 2019 and payable in 2020.

The Auditor’s Office cannot provide relief for taxes, except through credits on Homestead, CAUV, and Owner Occupancy. If property owners believe their value is correct but taxes are too high, the Auditor has no authority to help. If the owner believes a value is incorrect, we would encourage them to contact our office. More information can be found here.

4677