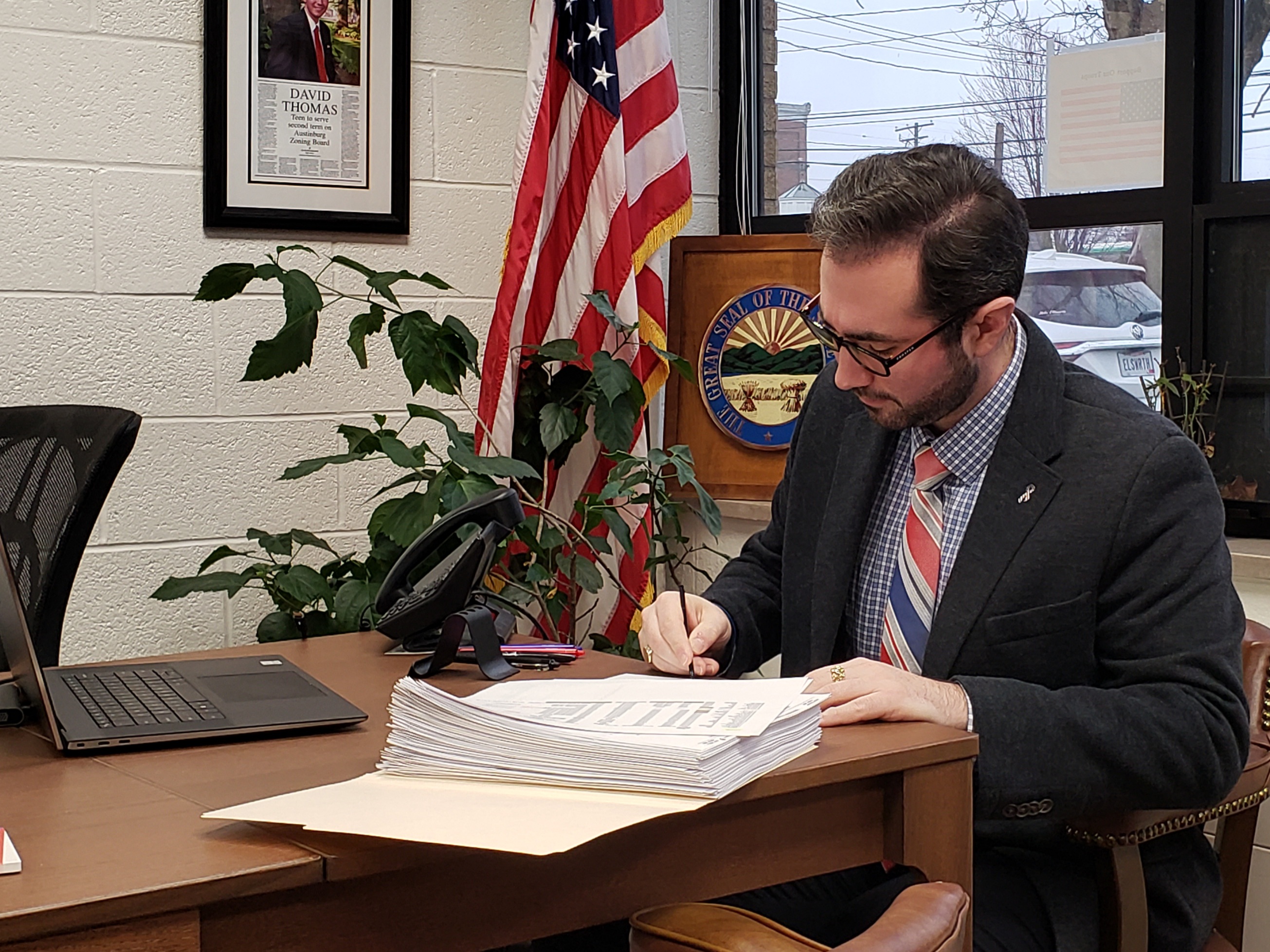

Auditor’s Office Disburses over $63 Million of Property Tax Revenue

Jefferson- Ashtabula County Auditor David Thomas announced the distribution of over $41 million in property tax revenue to the county’s school districts, municipalities and other governmental entities in Ashtabula County’s final settlement of taxes paid during the first-half property tax collection period this past week.

Thomas’ office has already advanced an additional $21.7 million in property tax funds to jurisdictions that requested them during the tax collection period. Traditionally schools will receive a prorated amount of tax revenue as taxes are paid to aid in cash flow as opposed to one large lump sum following collection.

“With this being a State Mandated Revaluation year, my goal was not only to get the values and tax rates in line based on state requirements, but also to educate tax payers and answer questions which are natural when changes happen,” explained Auditor Thomas.

The Auditor’s Office takes the money paid to the County Treasurer through collection and determines distribution based on levies to the local taxing authorities which make up property tax bills.

Of the total $63 million distributed for the first half, the largest portions were distributed with $34.4 million going to school districts, $10.4 million to county wide agencies, $7.3 million to townships, and $5 million to cities.

The county agencies include $3.9 million to the Board of Developmental Disabilities, $2.2 million to Children Services, $2 million to the Commissioner’s General Fund, and $1 million to the Senior Levy.

The distribution process involves complex formulas and factors with over 60 taxing districts, each with its own rate. The auditor’s office must account for and distribute over $100 million in taxpayer dollars, twice a year.

“I have seen many myths online about how we did our revaluation to increase revenue due to the pandemic,” said Auditor Thomas. “Obviously, nothing can be further from the truth as this is a mandated every six-year process by the state, with parameters for values from sales, and government revenue by and large isn’t effected by the revaluation.”

The Auditor’s Office has web pages on their site with explanations and videos explaining tax distributions for individuals’ bills, the concept that government revenues stay largely flat despite changes in values, and the process for appealing property values through the Board of Revision.

New levies in Saybrook, Conneaut, and Geneva were one reason tax revenues increased this past year for collection. Only 10 mills of property owners’ tax bills, $350 for a $100,000 home, are unvoted tax charges. The remainder is decided by voters in the form of levies on residents’ ballots.

Those with questions on their value, property tax credits, or tax distribution can contact Auditor David Thomas at djthomas@ashtabulacounty.us or visit www.auditor.ashtabulacounty.us and call 440-576-3783.

4728