Homestead & Tax Payment Education Session

Watch the Conneaut Session Recording on April 20th!

Register for the Zoom Option for April 25th at 5pm

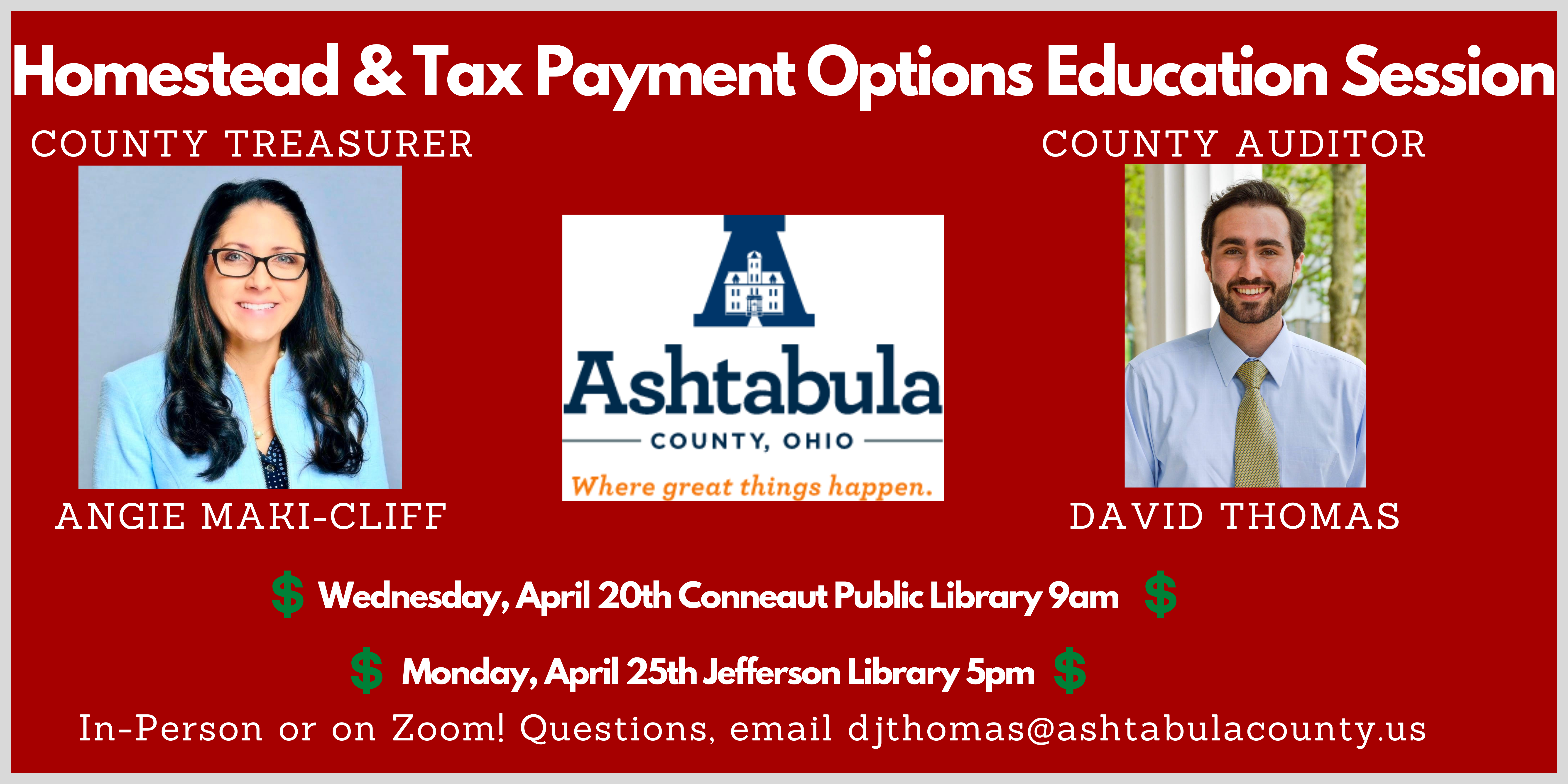

County Auditor & Treasurer to Host Joint Tax Credit and Payment Education Session

Jefferson- Ashtabula County Auditor David Thomas and Treasurer Angie Maki-Cliff will be taking to the road in April to educate county property owners on tax payment services available to them and tax credit information they could be eligible for this year.

“I am really excited to bring this opportunity back in person this year to our local residents so you can learn and ask questions of the Treasurer and me,” said Auditor Thomas.

The sessions will be held at the Conneaut Public Library on Wednesday, April 20th at 9am and at the Henderson Memorial Library in Jefferson on Monday, April 25th at 5pm.

“Even though I am still in my first year in office, there’s been many changes that tax payers can benefit from hearing about so I look forward to sharing at these sessions,” explained Treasurer Maki-Cliff.

The Auditor’s Office estimates nearly 70 people attended their Homestead sessions prior to Covid and they anticipate similar turnouts this year. Those who are unable to attend can watch online by Zoom or Facebook live. To register for Zoom, attendees can visit the County Auditor website or contact Auditor Thomas at 440-576-3785 or djthomas@ashtabulacounty.us. No pre-registration for in person attendance is needed.

County Auditor Thomas plans to inform attendees about tax credits including the Homestead Tax Credit, Owner Occupancy Credit, and property value questions relating to how taxes are determined.

Tax payers who are 65 years or older and own their home with an annual adjusted Ohio Gross Income of less than $34,600, are permanently disabled, or are military veterans permanently disabled from a service related injury are encouraged to attend one of these sessions to learn more about the program. These are the basic qualifications for Homestead.

Homestead tax savings for applicants include a reduction equaled up to $25,000 tax credit on the market value of the home for traditional Homestead and $50,000 for disabled military veterans.

“At one of our last sessions, it was a real honor to meet a military disabled veteran who didn’t know about the credit and we were able to get him the money he qualified for which was awesome,” stated Auditor Thomas.

County Treasurer Maki-Cliff will discuss payment options residents, especially seniors, may find beneficial such as payment plans and an email electronic bill. Residents can sign up to receive their property tax bill by email, saving money and time according to the Treasurer’s Office.

“Those who winter in Florida or worry about the mail, can sign up and be guaranteed their bill gets to them and then taxpayers can easily pay online or however most convenient for them,” shared Treasurer Maki-Cliff.

3637