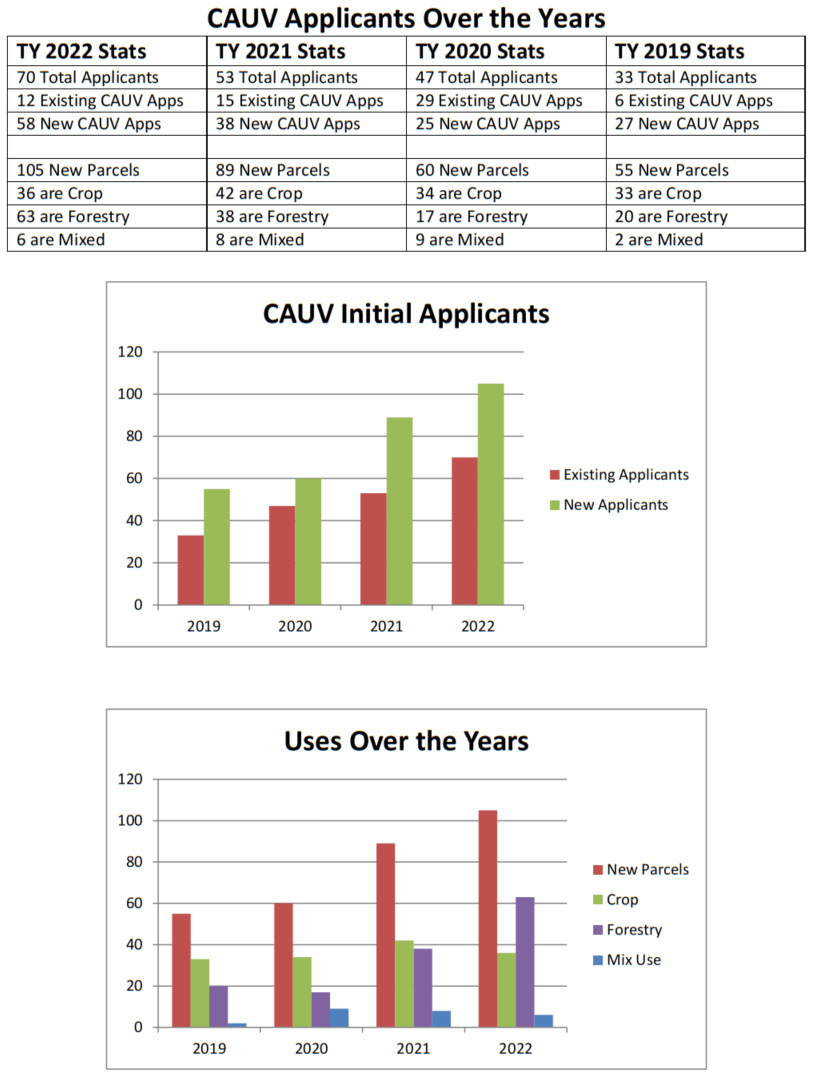

Higher CAUV Participants for 2022!

Through more education and more savings, the Ashtabula County CAUV Participation reached another high for 2022 with more acres, parcels, landowners, and positive agriculture practices.

To learn more about CAUV, click here.

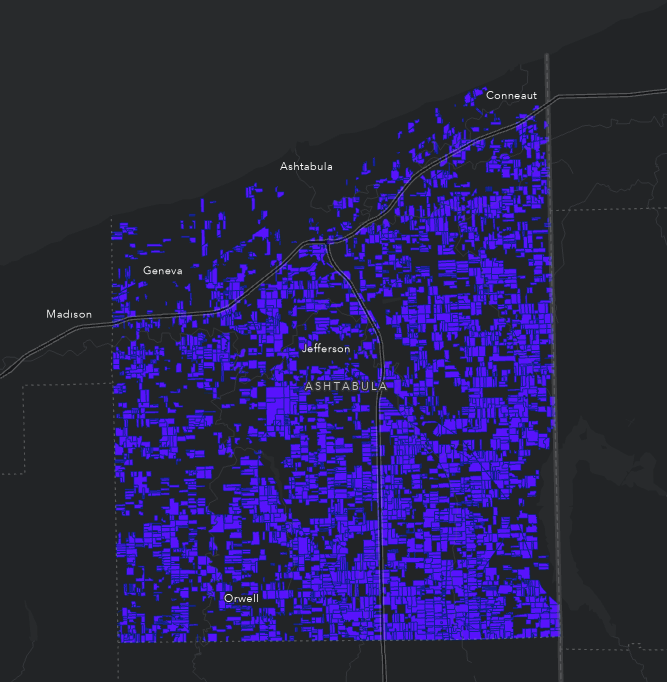

A very telling picture. All Parcels in the CAUV Agriculture Tax Savings Program are in Blue. As you can see, Ashtabula County is heavily situated in Commercial Agriculture. In fact, this is our largest industry! When a property is in CAUV, instead of being taxed at the full market rate for value, the value is determined by state formulas from the soil types below the farm. Usually, this is a roughly 75% savings. The difference is made up by other property owners in the taxing district. This is because remember, local government revenue, regardless of changes in value, credits, or BORs, remains flat.

3404