State Mandated CAUV 2023 Values Released

Watch a Townhall video from Auditor Thomas explaining the CAUV Value changes

See average savings for property in CAUV by tax district.

1. Click here to view the Press Release with details on changes in CAUV Values.

2. Click here to view the changes in 2020 Values vs 2023 Values for Soil Types.

3. Click here to view a PDF of Soil Values going back to 2011.

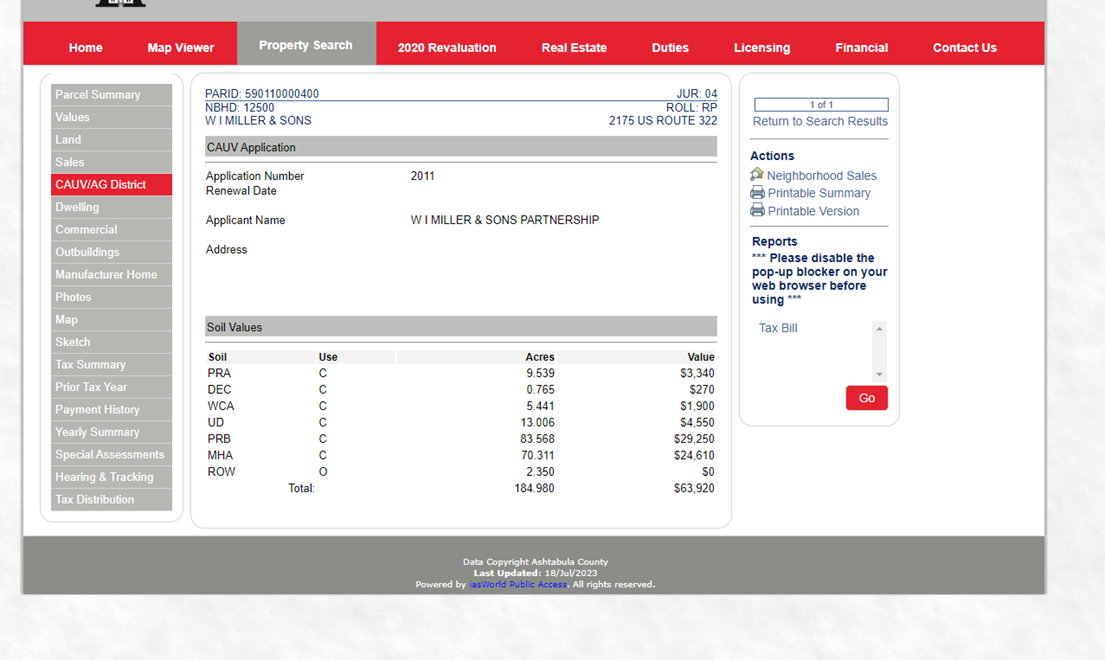

4. Click here to view your soil type on our Property Search feature

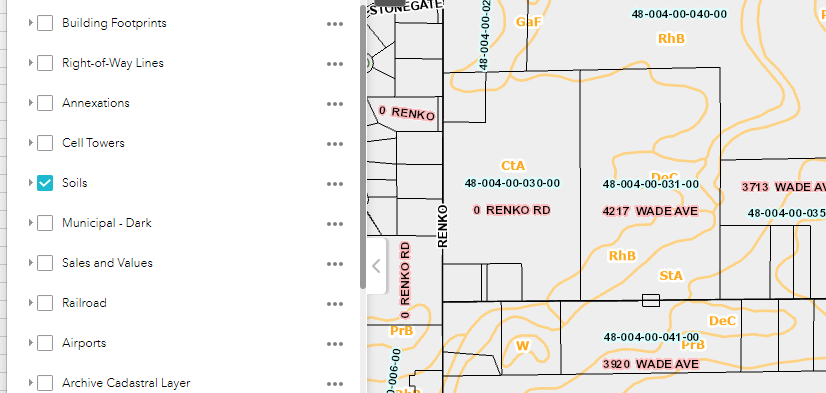

5. Click here to view your soil type on our GIS site by click the option for soils as seen here.

6. Click here to read an info packet created by the Ohio Department of Taxation to describe the CAUV formula and why the increase occured this year.

7. Click here to watch a video on the CAUV Value changes.

8. Click here to watch a video more in depth on the CAUV Formula.

9. Click here to visit the Ohio Farm Bureau website for CAUV resources and information.

Auditor Thomas releases State Mandated CAUV Value Updates for 2023

Jefferson- The State of Ohio Department of Taxation released finalized Current Agricultural Use Valuation (CAUV) values for Ohio soil types in the CAUV program for 2024 with increases in values for most soil types.

“CAUV is a tax savings program for land that produces agricultural products by valuing the soil types of the farm for taxation purposes,” according to County Auditor David Thomas, “CAUV soil values consider the cost to produce the crops and average crop market prices which leads to a lower value than if the Auditor were to assign a traditional market value.” (Learn about CAUV here.)

Thomas stressed that changes in value do not match changes in taxes dollar for dollar. “We want property owners to be prepared for the coming changes and we’ll be hosting webinars, meetings, and other opportunities to discuss these changes,” said Auditor Thomas.

Every three years the State of Ohio releases new CAUV values for counties in a property value update year as Ashtabula County is this year. Thomas shared that over the past several updates, values have stayed relatively consistent since they spiked in 2014 and the State changed their formula.

2023 however will be a year of large increases to CAUV values in comparison to the values currently used from 2020 in Ashtabula County. “The formula used by the State of Ohio takes into account farm data from Ohio farmers over the past five years and we see that as with everything else today, prices and amounts have increased in comparison to 2020,” explained Auditor Thomas.

Ashtabula County has 108,214 acres in CAUV cropland and woodlands with 68 different soil types the State of Ohio updates values for every three years. As an example, Thomas explained that the most popular soil type in Ashtabula County for cropland with 39,688 acres is MhA—Mill silt loam. This soil value will change from $350 an acre to $1090 an acre in value, a 311% increase. (See the new values here.)

“The CAUV value will still be significantly less than market value and farmers will still see a large savings being in CAUV,” said Auditor Thomas. “But just like what we are seeing with market values and the real estate market being very hot these past three years, the State of Ohio is mandating these value increases also.”

Taxpayers can review their current CAUV soil values on the Auditor’s website in GIS or the property page for a parcel clicking CAUV/Ag District to compare to the New 2023 Soil Values here.

“We are still working on the State Mandated Triennial property value process with the State of Ohio and our third-party appraisal firm,” stated Auditor Thomas. “Just like with CAUV value changes, once we know numbers for property values in 2023 I will release them and we will do postcards and outreach to educate folks as soon as possible.”

The new values are as of January 1, 2023 and will impact the tax bills that arrive in January 2024. Opportunities to discuss the new values will be indicated on the post cards arriving in the mail later this year.

Those with questions or concerns are encouraged to contact Auditor David Thomas anytime at 440-576-3785 or djthomas@ashtabulacounty.us

9909