2024 Tax Amounts Certified- All You Need to Know

Questions on your Tax Charge or Property Value?

Every 3 years the State mandates a Triennial Update of market values in every county based on neighborhood real estate sales. Your new value is based on the market rate on Jan 1, 2023. Your old value is based on the market from Jan 1, 2020. Inflation, interest rates, demand, and supply all go into what is the market- the price a willing buyer and seller can agree to.

The Auditor is a creature of Ohio Law and Statute. The Auditor has little to no discretion with the Property Tax process. To discuss your ideas and thoughts for policy changes, contact your Ohio Legislator here.

2nd Half Tax bills are due to the Ashtabula County Treasurer by July 15th

See sales in your area which were used to determine market increases in values.

Frequently Asked Questions-

- Q: I've done nothing to my house, why did my value increase? A: The market determines value for real estate. The market moves up and down as buyers purchase property. Your old value is from the 2020 market and your new value is based on 2023. See neighborhood sales here.

- Q: Why did you change my value? A: Every 3 years Ohio has counties update property values to remain consistent for taxation and update to date with market data. See neighborhood sales here.

- Q: Where will my increase in taxes go? A: Most levies are fixed revenue, meaning we decrease the tax rate as your value increases to generate the same district revenue. 10 mills of your tax rate moves with value and is split among all local entities. An additional amount is guaranteed to all school districts. Watch where here.

- The Tax Millage guaranteed to schools, 20 Mills, means that if a school is receiving less millage, we must apply the difference to new values.

Great article from the Columbus Dispatch with an overview of Property Tax need to knows.

1. If you are not happy with your tax amount or want to learn more- first look at your Property Value.

- Click here to see how to find your value.

- Did your taxes increase more than your value? Or want to know where your higher taxes went? Learn more here.

- Watch a video from Auditor David Thomas explaining how to use Auditor Office resources to learn about your property value and taxes.

- Watch a webinar from Auditor David Thomas giving an overview of Property Taxes 101 for Property Owners!

- Click here for a PDF explaination of Tax Rates, Value Changes, and the Auditor's Role.

2. Do you agree with the 2023 value (if yes, then go to #3). If no, your old Value is from the market value amount our office believed to be correct for your property on January 1, 2020 and your new value is for January 1, 2023. If you believe your new value is not what your property is worth on the market for January 1, 2023:

-Read about the Revaluation Process- See neighborhood sales, value maps, and read as we looked at all 80,000 parcels in the County to determine your updated market rate for January 1, 2023.

-See neighboorhood sales that market changes were based off of here.

-Read about and File a Board of Revision complaint to challenge your property value

3. If you believe your value is correct but you are not happy with your tax amount:

-Learn about tax credits which may be available to you- Homestead and Owner Occupancy or CAUV

-Watch a webinar from Auditor David Thomas giving an overview of Property Taxes 101 for Property Owners!

-Click here for a PDF explaination of Tax Rates, Value Changes, and the Auditor's Role.

- Click here to view a map of the tax rates by district for how much your taxes compare to others.

4. If you would like to set up a payment plan, pay your bill, or learn about payment options, visit the Treasurer's Website here.

5. If you would like to contact our office to learn more or ask questions:

-Click here to contact us

-Click here to read more information

More information important to know for your property value and taxes

The Auditor’s Office role in your tax bill is to assess the market value on your property and calculate your taxable amount based on your location and tax district. The Auditor’s website has a good amount of information for you on your valuation and tax information.

For questions regarding your valuation, please contact the Auditor’s Office at 440-576-3783. For questions regarding payments, please contact the Treasurer’s Office at 440-576-3727.

Below are examples of screens on the Auditor’s website which have important information for your property. It is important to note that all values and tax amounts are based on 1/1/2023.

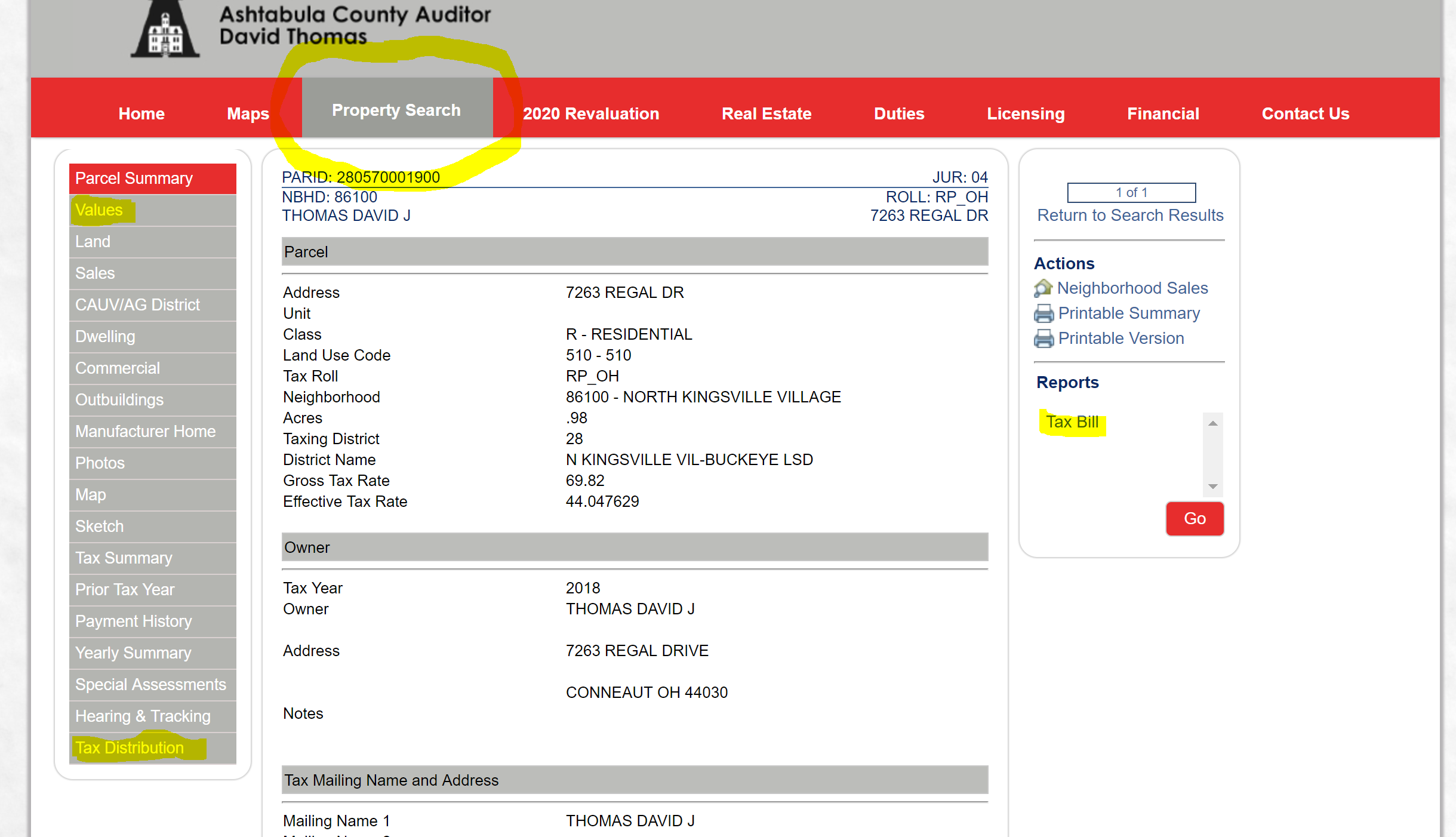

The Parcel Summary tab shows the page after you have searched your property. This is the main screen for your values and will direct you towards a treasure trove of individualized info. Residents can also print off their individual tax bill by pressing tax bill on the right side of the screen. You must turn pop-up blocker off and should print the bill in Full Size (not the defaulted Shrink to Fit):

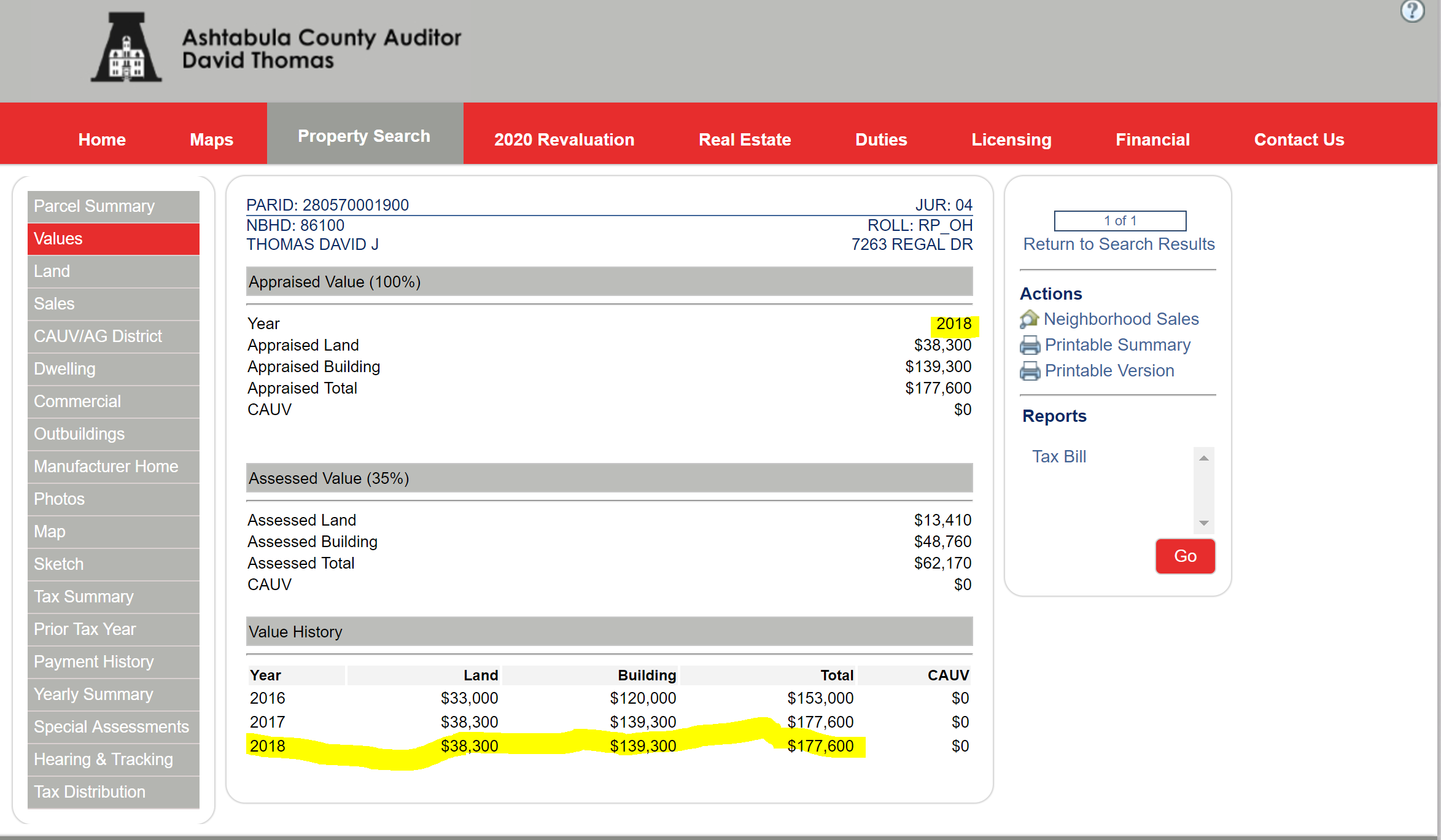

The Values tab displays the values of your property over the past 3 years on January 1st of each year:

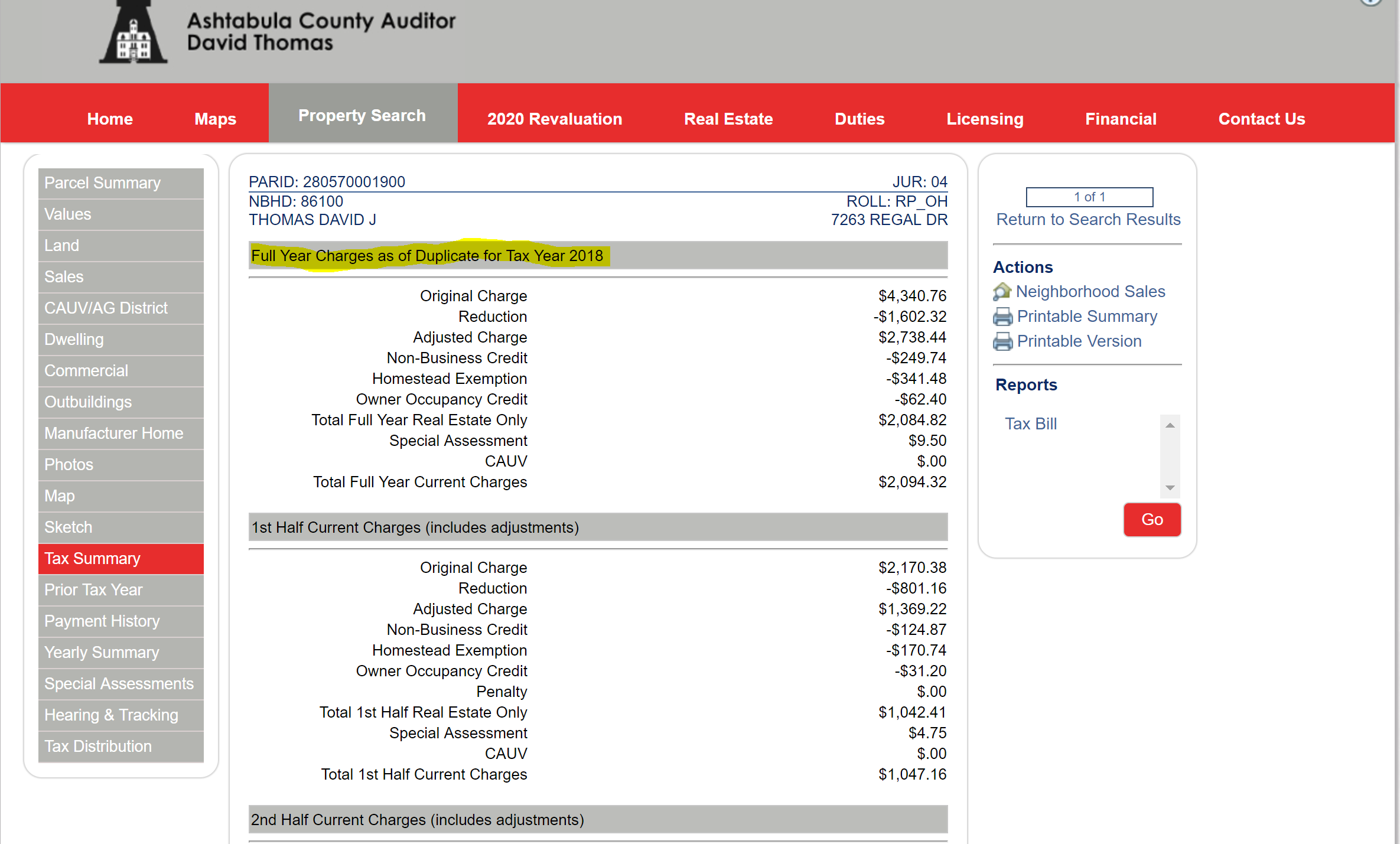

The Tax Summary tab shows the tax calculation on your property and any tax credits you may be receiving and the reduction of your tax burden based on the local tax district:

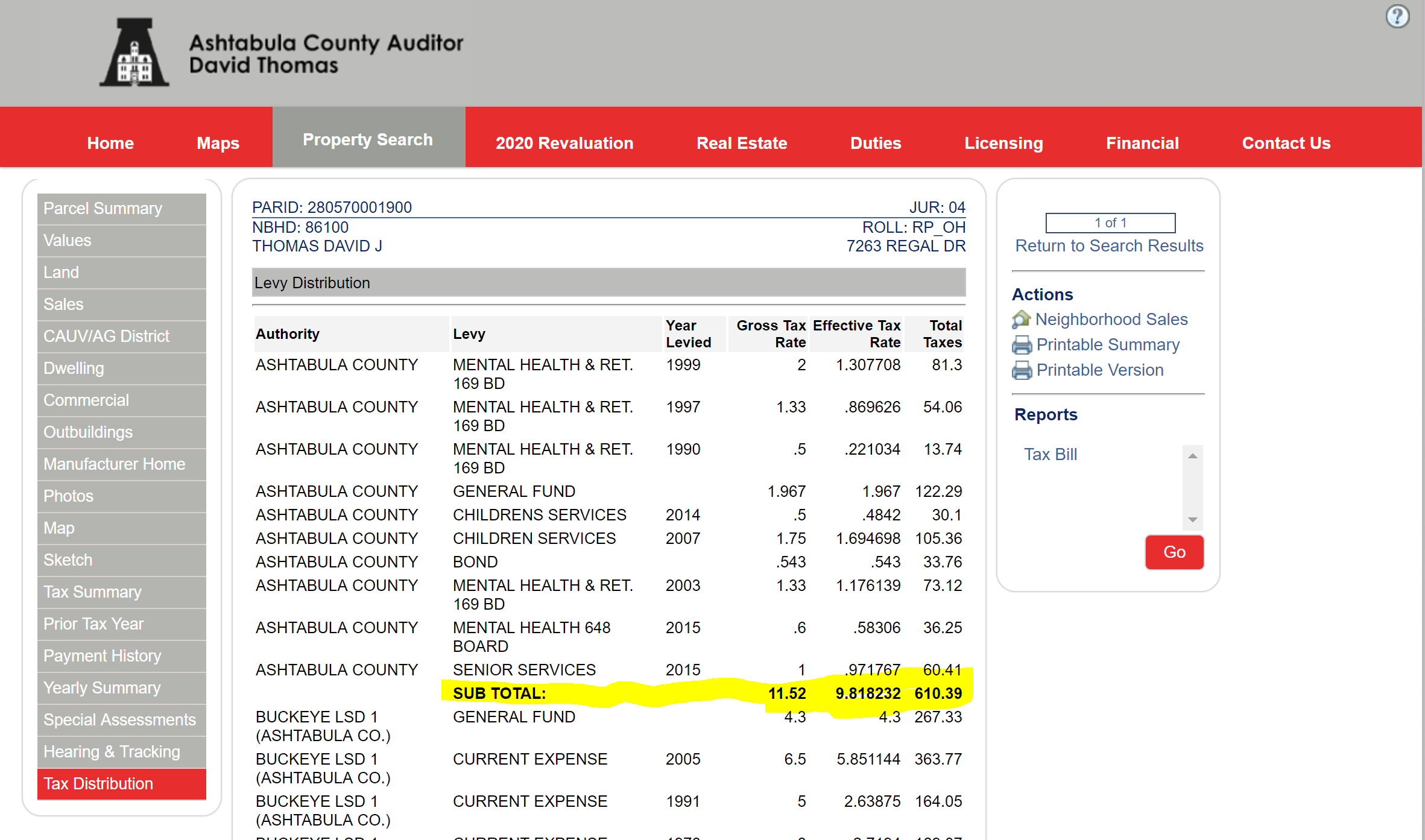

The Tax Distribution tab gives your total tax distribution based on each levy. This screen shows the amount of mills in collection for each levy in your tax district as well as the total distribution per authority for your tax dollars:

Should you have any questions over these tabs or other matters, please don’t hesitate to contact the Auditor’s Office today!

13813